How Crystal Girl Breaks Our Monetary System (Part I)

Several years ago, I shared a long Uber ride in South Beach with an attractive girl in her early 20s who was into crystals – not crystal meth – but healing crystals. She believed crystals had unique vibrational qualities that cured your illnesses. She ended the ride by offering to sell me some.

I didn’t make much of the conversation - the attractive, minimally educated female who is grifting through life is a common encounter in Miami, but it did make me think – where does a girl with a crystal hustle end up?

This past month, I found out.

I ran into her at an Art Basel event. She was dressed better – still rocking the same upscale hooker attire that girls wear out in Miami but doing it with more expensive labels. Crystal girl was now rich having made millions off of a NFT project.

We talked briefly and I learned all about it – it was as incomprehensible as her healing crystals. Afterwards, I turned to my friend and said – “that girl dressed like a stripper has a higher net-worth than 95% of America’s doctors.”

“How?” my friend asked.

“She sold rainbow jpegs I think.”

“America is so f---ed,” my friend replied.

He was right.

Crystal girl is not a feel-good story. She is the gargantuan problem that Jerome Powell and America’s financial markets must overcome.

Let me explain.

We often think of inflation as one thing – the cost of everyday goods and services as reflected by a measure like CPI (consumer price index).

When we look at that number it has been relatively sanguine. This is what it looked like over the last 40 years.

Inflation being low is a good thing. With inflation low, the Fed does what it wants and what it wants to do is please us and what pleases is free money whenever things go bad. We’re like a trust fund kid who is constantly getting bailed out by his parents.

When the economy is booming, the Fed will tentatively raise rates a little but when the economy falters, the Fed drops them hard. In each crisis, rates go to a lower level than the prior crisis.

During the Great Financial Crisis, this pattern repeated except the Fed not only lowered rates but injected cash into the economy by buying bonds.

They kept the liquidity heroin drip up long after the crisis was over. In fact, we were just starting to remove the IV, when Covid happened. Covid caused the Fed to massively up the dosage.

Below is a graphical representation of how much heroin (free money) is coursing through America’s veins right now.

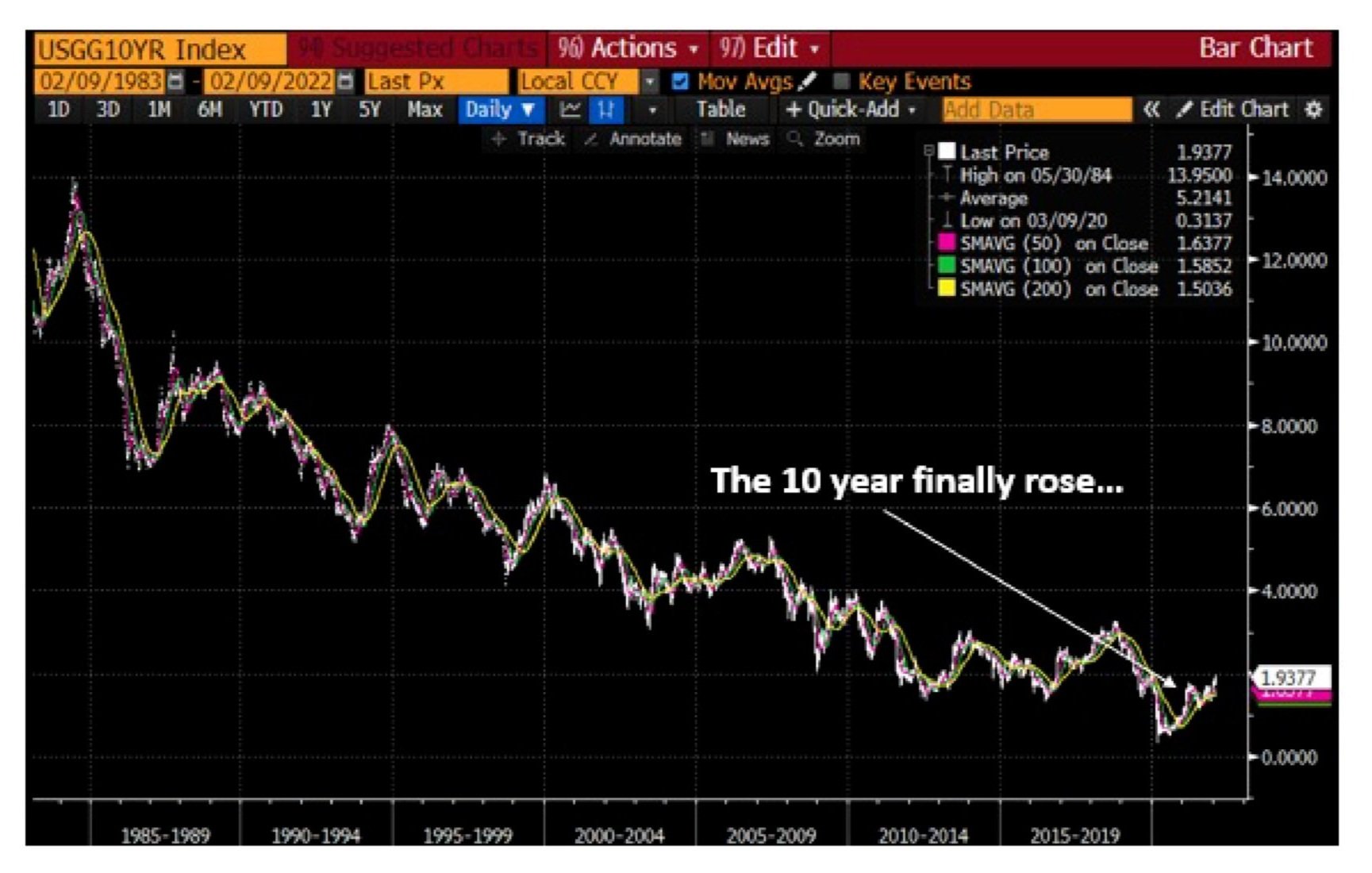

All of this has meant that the yield the 10-year treasury has just gone down and to the right – almost in perpetuity.

It looks on the surface that the Fed has been able to conduct this crazy monetary experiment with no negative repercussions - we haven’t had any inflationary comedown.

But that isn’t the whole story.

You see over the last forty years, there has been inflation – just not for everyday goods and services that the Fed measures.

The inflation has been happening with assets - stock prices and home values have shot through the roof over the last forty years - as you can see below while real economy prices has stayed low.

Goods and services that resemble assets are up a lot too. College education costs 15x more than what it did in 1980.

But those ballooning asset prices aren’t causing regular inflation – the sort that appears in CPI.

Why is that?

Well, the answer is because rich people don’t turn their incremental wealth into goods and services that regular people buy.

In other words, Jeff Bezos isn’t changing his consumption of La Croix or barbecue grills when he goes from being worth $10 billion to $100 billion.

Now he might spend more money on high end real estate – and we’ve seen an explosion of prices there (Ken Griffin bought an apartment for $240mm in NYC) but the price of NYC townhouses are not part of the CPI.

But what is true about the wealthy, is not true about the ordinary or the poor. If you give someone who has no money, an incremental $1mm, they will spend a portion of it.

Crystal girl is a case in point. Two years ago, she was living with three other roommates and shopping at Costco. A few jpegs later, she lives in her own apartment and shops at Saks. It was like she was starring in her own version of the movie Dumb and Dumber, except rather than discovering a suitcase full of cash, she discovered Jpegs.

The irony is that this is sort of what our central bankers wanted to see happen when they pumped America with cash during COVID. They wanted buoyant asset prices to encourage people to spend more - otherwise the economy would have imploded.

But the liquidity pump was so large and so blunt that it had strange knock-on effects – like create a speculative market for farting rainbow gifs.

And that’s where things could get weird.

Crystal girl could represent the end of our multi-decade monetary experiment - she and her rainbow gifs could break the Fed.

Crazy speculation has two real world effects.

It first pulls labor away from productive jobs - why work hard at accounting or waiting tables when you can make a year’s salary trading crypto?

It also increases consumption - a bunch of people now have wealth that they can convert to demand for real goods and services.

Net-net you have less people working to provide goods and services and more people demanding them.

When that happens, prices rise – goods and services become more expensive.

And that is exactly what we have seen here. We are in the midst of a great resignation where whole groups of people have given up regular work to become full time speculators and that transition is causing a spike in CPI.

Now, you’ll hear pundits blame this rise on supply chain issues. But if you parse through the data, it is clear that supply chain can only be blamed for a small portion of the overall issues - the deeper reality is that what we are seeing is a final spill over effect of loose fed policy into the price of regular things - something that we haven’t seen in decades.

But shouldn’t we celebrate ordinary folks receiving speculative windfalls?

The answer in short is no.

Silly speculation whether its in stocks or houses or farting rainbows just creates massive capital misallocation. The folks who didn’t make money from this speculation and worked regular jobs now face a world that is more expensive.

And the fact that inflation now exists makes everyone’s economic realities more precarious.

And this is the key fact that everyone forgets, inflation’s very existence can beget more of it.

If you start to expect inflation to exist going forward, then you change your behavior and spend more in the present, which in turn begets more inflation.

If we end up in an inflationary spiral, then the whole system falls apart. That’s when hitherto normal populations elect dictatorships (as Germany did in the early 30s) or fall into deep economic depression as Venezuela has done.

The good news is that the Fed gets that they went too far and are signaling the need to re-think policy. This signaling has caused the 10 year to rebound and aggregate wealth to fall.

But there is a scary question to ask – how much does the 10 year have to rise and aggregate wealth fall before Crystal girl is back to working a regular job?

Moreover, what if we are passed the point of no return?

We have had decades of easy monetary policy that has created absurd amounts of wealth and we imagine that such a regime should always continue. But what happens when the Fed breaks…

To be continued in Post 2...